Йо-хо-хо! Вчера на работе коллеги активно обсуждали повышение курса CHF к евро и подумывали о переезде во Францию.

Вроде как народ бросился в обменники:

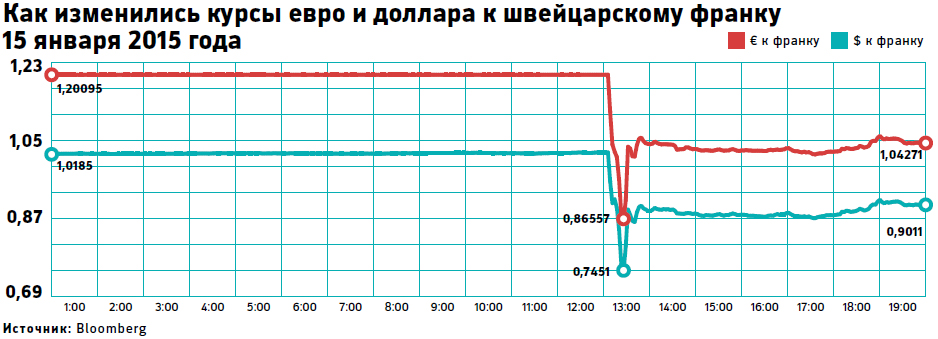

График курсов валют

Несколько ссылок себе на память:

http://www.forbes.com

QA

Вроде как народ бросился в обменники:

Я, к сожалению, плохо разбираюсь в этой теме, так что буду рада объяснениям и полезным ссылкам.

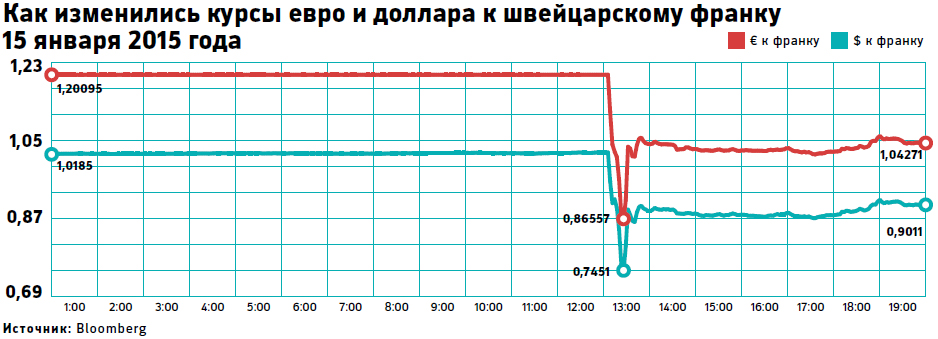

Пока что поняла, что Швейцарский Национальный Банк (SNB) с 2011 года сдерживал курс 1 евро /1,2 франка, поскольку удорожание нацинальной валюты било по швейцарским экспортерам, но вчера почему-то решил прекратить. И это сделало богаче тех, кто получает зарплату во франках, но подорвало доверие к SNB и чью-то экономику. Чью - я пытаюсь понять=)

Больше всего от изменения курса выигрывают "frontaliers": живущие во

Франции, Италии или Германии, там же платящие налоги, но работающие в

Швейцарии. Таких - около 280 000, особенно много в районе Женевы.

График курсов валют

Несколько ссылок себе на память:

http://www.forbes.com

QA

Here are five questions about Thursday’s move.

Why did the SNB cap the franc’s value?

During the eurozone’s debt crisis, the Swiss franc, long considered a safe haven in times of stress, appreciated sharply against the euro. That threatened the country’s manufacturers, which sell a significant share of their exports to the eurozone. In September 2011, the SNB set a goal of keeping its currency from rising beyond 1.20 francs to the euro.Did it work?

The Swiss economy has expanded more rapidly than the eurozone’s in recent years, but inflation remains near zero, suggesting the economy hasn’t escaped the risks of deflation.Why scrap the peg?

The SNB said that while the franc is still strong, “the overvaluation has decreased as a whole” since they set the cap. Analysts also said the target would have come under increased pressure in coming weeks, particularly if the European Central Bank launches quantitative easing next week as most analysts expect, increasing the supply of euros and likely leading to further euro depreciation.What does it mean for the SNB?

The central bank faces two immediate problems: its credibility and the potential for major losses on its balance sheet. The reversal may make it harder in the future for Swiss policymakers to persuade investors that its declared intentions are its real intentions. In addition, because the SNB holds a big chunk of its balance sheet in assets denominated in foreign currencies that will have fallen in franc terms, it faces large losses on those holdings.What are the lessons for other central banks?

The Swiss case shows how hard it is for central banks to maintain supposedly temporary, emergency measures for long periods, and insulate their economies against major external developments. It also underscores how hard it is for smaller central banks such as Switzerland’s to hold back the tide of markets that are driven by the policies of larger central banks such as the ECB and the U.S. Federal Reserve.

Комментариев нет:

Отправить комментарий